Bitcoin short squeeze: Recent short position surges in the Bitcoin market have sparked worries about a possible short squeeze that would drastically affect the price of Bitcoin. Held in a significant short position valued at $370 million, a Bitcoin whale has been the focus of market conjecture. Many people ask if the market allows an unheard-of squeeze to develop.

Short Positions and High-Risk Bitcoin Bets

Under a short position, you borrow an asset—in this case, Bitcoin—then sell it for the current market price with plans to repurchase it later at a reduced price. If there are fewer related expenses, the difference between the selling and repurchase prices shows the profit. The short seller risks endless losses, though, if the asset price rises rather than declines.

The whale’s $370 million short bet shows a major negative attitude toward Bitcoin’s price movement. Such a big stake exposes the trader to great danger even while it points to strong conviction. Given Bitcoin’s past volatility, this approach becomes even more unpredictable, considering the possibility of fast price swings.

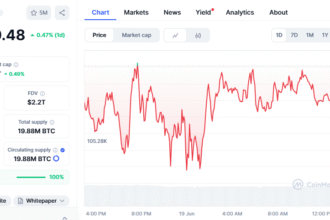

Prices in the bitcoin market are erratic and fast-moving. Large short holdings can add to this volatility, particularly when the market swings against the expectations of the short seller. Should a price rise require short sellers to buy back the borrowed Bitcoin to cover their positions, a chain reaction of buy orders results. This phenomenon, called a “short squeeze,” can cause a significant and quick price increase.

A short squeeze results from an unanticipated increase in the value of an asset that forces short sellers to purchase back shares to cover their bets, raising the price. Regarding Bitcoin, if the price were to climb significantly, the whale’s short position might cause central purchasing pressure as they try to minimize losses, hence perhaps magnifying the price gain.

Impact of Large Bitcoin Transactions

Although the bitcoin market is still new compared to conventional financial markets, there have been cases when big stakes have caused notable price swings. For instance, a $370 million Bitcoin transaction between two unidentified wallets drew the interest of the market in May 2022, therefore underscoring the influence of significant trading on Bitcoin’s price volatility.

Whale’s Short Position and Bitcoin Volatility

The disclosure of the whale’s short posture fuels the speculative character of the bitcoin market. Investors and traders closely monitor things since many see a possible short squeeze. As market players respond to the changing environment, this expectation might cause rising trade volumes and more volatility.

Cryptocurrency Trading Risks and Regulations

Extensive short holdings expose specific hazards, especially in erratic markets like cryptocurrencies. Given the possibility of quick price swings, traders risk losing a lot in a short time. Marketlayers must evaluate risk tolerance, research extensively, and apply risk management techniques. when engaged in such trading

Operating in a complicated regulatory context with differing degrees of control across several countries, the bitcoin industry is susceptible to any changes that affect market stability, big trades and positions may draw regulatory attention. To guarantee compliance and reduce possible legal risks, traders should know the legal and regulatory systems controlling their operations.

Summary

The $370 million short bet of the Bitcoin whale adds another degree of complexity to the bitcoin market. Although it emphasizes the vast stakes in bitcoin trading, it also shows the possibility of notable price swings from big bets. Given the inherent dangers and volatility of bitcoin markets, market players should remain alert, stay informed, and use care as the situation evolves.