Bitcoin was designed as a decentralized alternative to state-controlled money, yet one of the biggest ironies in modern finance is that governments around the world now control significant amounts of it. These Bitcoin holdings didn’t appear overnight, and they weren’t built through the same strategies used by corporations or hedge funds. Instead, governments accumulated their coin piles through a mix of criminal seizures, court-ordered forfeitures, strategic purchases, and—more recently—direct involvement in Bitcoin mining using state-linked infrastructure.

Understanding how governments built massive Bitcoin holdings isn’t just a curiosity for crypto enthusiasts. It matters because when a government moves or sells a large quantity of Bitcoin, it can shake markets, trigger speculation, and change public perceptions of legitimacy. It also raises philosophical questions: can Bitcoin remain “anti-establishment” when states themselves are among the largest custodians? And what happens when those holdings become tools of diplomacy, enforcement, or even economic survival?

This article explores the real pathways that led governments to accumulate major Bitcoin holdings, from headline-grabbing raids to quiet policy frameworks. We’ll unpack why the public often misunderstands government-held Bitcoin, how custody works, what motivates liquidation versus long-term storage, and how mining—once purely private—has become a state-aligned strategy in certain regions. Along the way, we’ll connect the dots between law enforcement, financial policy, and the evolving role of digital assets in sovereign decision-making.

How Governments Ended Up With Bitcoin in the First Place

Most people assume governments built Bitcoin holdings because they bought Bitcoin as an investment. That does happen in some cases, but the most common starting point is much simpler: law enforcement takes it. When criminals use Bitcoin for illicit payments, money laundering, ransomware, or fraud, they often leave a trail behind. If investigators gain access to private keys, exchange accounts, or hardware wallets, they can seize the assets and transfer them into government-controlled wallets.

Unlike traditional asset seizures—where authorities might impound cash, cars, or property—Bitcoin can be collected instantly and stored in a digital address. That speed is one reason Bitcoin became attractive for crime, but it’s also why authorities can efficiently capture it when cases break open. Over time, this pattern has produced large and sometimes surprising government Bitcoin reserves.

Another key reason governments ended up with massive Bitcoin holdings is that Bitcoin is borderless. Criminal activity spanning multiple jurisdictions often results in multiple agencies securing portions of the same network of wallets. That creates fragmented government ownership across countries, but it still totals enormous amounts globally.

Seizures and Forfeitures — The Most Common Source of Bitcoin Holdings

The dominant route to Bitcoin holdings is seizure and forfeiture. These are not the same thing, and understanding the distinction helps explain why governments sometimes hold Bitcoin for years.

Seizure vs. Forfeiture — Why Governments Can’t Always Sell Immediately

A seizure typically happens during an investigation. Authorities take control of suspected proceeds of crime, but the owner may still contest that seizure in court. Forfeiture happens later, after a legal process determines that the assets are connected to criminal activity and can be permanently taken by the state.

This is why a government can publicly announce a massive Bitcoin seizure, but those coins might not hit the market for months or even years. The legal process matters, especially in jurisdictions that require detailed proof and allow lengthy appeals. During that time, the government effectively becomes a temporary custodian of Bitcoin holdings rather than the outright owner.

High-Profile Cases That Built Massive Bitcoin Holdings

Major Bitcoin-related crime cases often involve darknet marketplaces, laundering networks, and large-scale fraud. When these operations are dismantled, the resulting seizures can be enormous because criminals frequently hold proceeds in Bitcoin, often in wallets designed to obscure ownership.

What makes these cases important isn’t just the quantity of Bitcoin seized; it’s the precedent they set. Each successful seizure strengthens investigative playbooks and signals that even “anonymous” crypto activity can be traced with enough persistence. That feedback loop results in more seizures, which further increases government Bitcoin holdings and reinforces the idea that Bitcoin is not beyond the reach of enforcement.

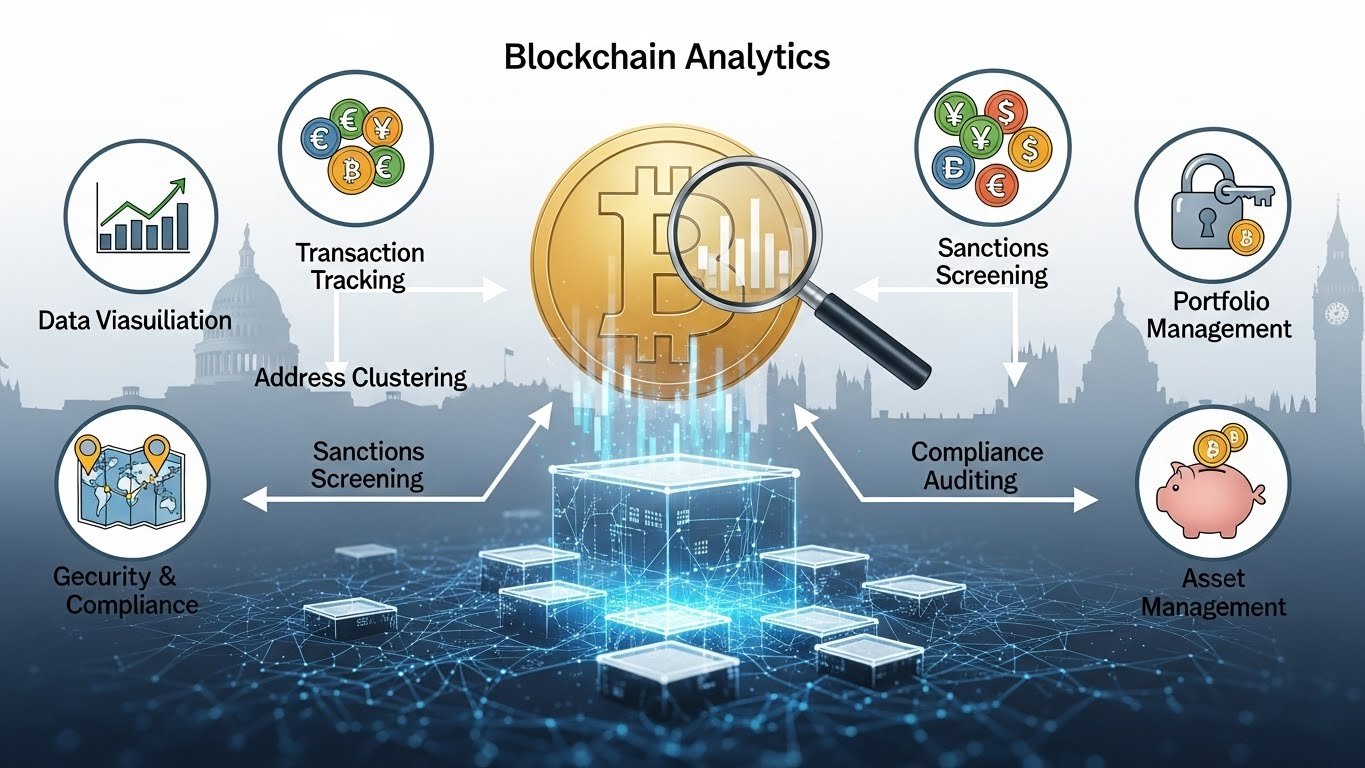

Role of Blockchain Analytics in Government Bitcoin Accumulation

A modern government’s ability to build Bitcoin holdings through seizures would be far weaker without blockchain analytics. Investigators can trace flows between addresses, identify clusters of activity, and link wallets to exchange accounts. Combined with subpoenas, KYC records, and forensic work, this often leads to recoverable Bitcoin.

The public sometimes imagines Bitcoin as untraceable, but Bitcoin’s blockchain is transparent. That transparency is a major reason governments have successfully recovered large quantities. In many cases, the key challenge isn’t tracking the coins—it’s finding the private keys and proving the criminal connection in court.

Auctions, Liquidations, and the Myth of “Governments Dumping Bitcoin”

When people hear about state-controlled Bitcoin holdings, they often fear that governments will suddenly sell everything and crash the market. The reality is more structured—and often more cautious.

Why Governments Use Auctions Instead of Open-Market Selling

Many governments prefer auctions for selling seized Bitcoin because auctions reduce accusations of market manipulation and create a transparent, documented process. Auctions also help governments comply with procurement rules and public accountability requirements. Instead of quietly selling on exchanges, they sell to vetted bidders, sometimes in large blocks, at market-related pricing.

This has an important effect: auctions can reduce market shock. Even when large quantities are sold, they are often absorbed by institutional buyers who intend to hold or distribute gradually. This makes the relationship between government Bitcoin reserves and price volatility more complex than “government sells, price drops.”

Strategic Timing and Market Sensitivity

Government agencies are not blind to market impact. While not every jurisdiction has a sophisticated crypto strategy, many authorities understand that rushing to liquidate can reduce proceeds. As a result, some governments delay liquidation during major downturns or coordinate sales in ways that avoid extreme disruption.

However, uncertainty remains. When a government wallet moves Bitcoin, traders watch. Even if it’s only an internal transfer between custody addresses, the market can interpret it as preparation for sale. This psychological factor makes Bitcoin holdings by governments influential even when no selling occurs.

Where the Money Goes After Bitcoin Sales

Another overlooked point is that when governments liquidate Bitcoin, the proceeds often go into general funds, enforcement budgets, victim compensation, or specific legal accounts depending on local law. That means the state’s incentive isn’t always to “invest” in Bitcoin long-term but to convert confiscated value into national currency for public use.

Still, the fact that governments can turn criminal Bitcoin into state revenue creates a recurring cycle that encourages continued enforcement focus—resulting in more massive Bitcoin holdings over time.

Government Purchases — When States Decide to Buy Bitcoin

While seizures remain the biggest source, some governments have directly purchased Bitcoin. This is the most controversial path because it signals political intent rather than legal consequence.

Bitcoin as a Treasury Strategy

In certain cases, policymakers have viewed Bitcoin as a hedge against inflation, a bet on digital transformation, or a branding strategy to attract investment and tourism. The appeal is obvious: Bitcoin has historically shown strong long-term growth, and its fixed supply narrative fits well with countries facing currency instability.

But purchasing Bitcoin exposes governments to volatility and political backlash. A drawdown can become a headline that damages credibility. That’s why large-scale sovereign buying is rare, yet even small official purchases can contribute to overall government Bitcoin reserves and inspire other states to consider similar moves.

The “Signaling Effect” of Sovereign Bitcoin Holdings

When a government publicly buys Bitcoin, it sends a signal to global markets. It suggests confidence in Bitcoin as an asset class and a willingness to integrate crypto adoption into national policy. Even if the amount purchased is modest, the narrative impact can be huge.

That narrative can create a feedback loop: media coverage drives public interest, public interest increases pressure for regulation, and regulation—whether restrictive or supportive—shapes future accumulation. In that sense, government purchase strategies are not only about Bitcoin holdings but about influence over the broader digital asset ecosystem.

Mining Rigs and State Power — How Governments Mine Bitcoin

The phrase “from seizures to mining rigs” highlights a key evolution: some governments aren’t just taking Bitcoin; they are producing it.

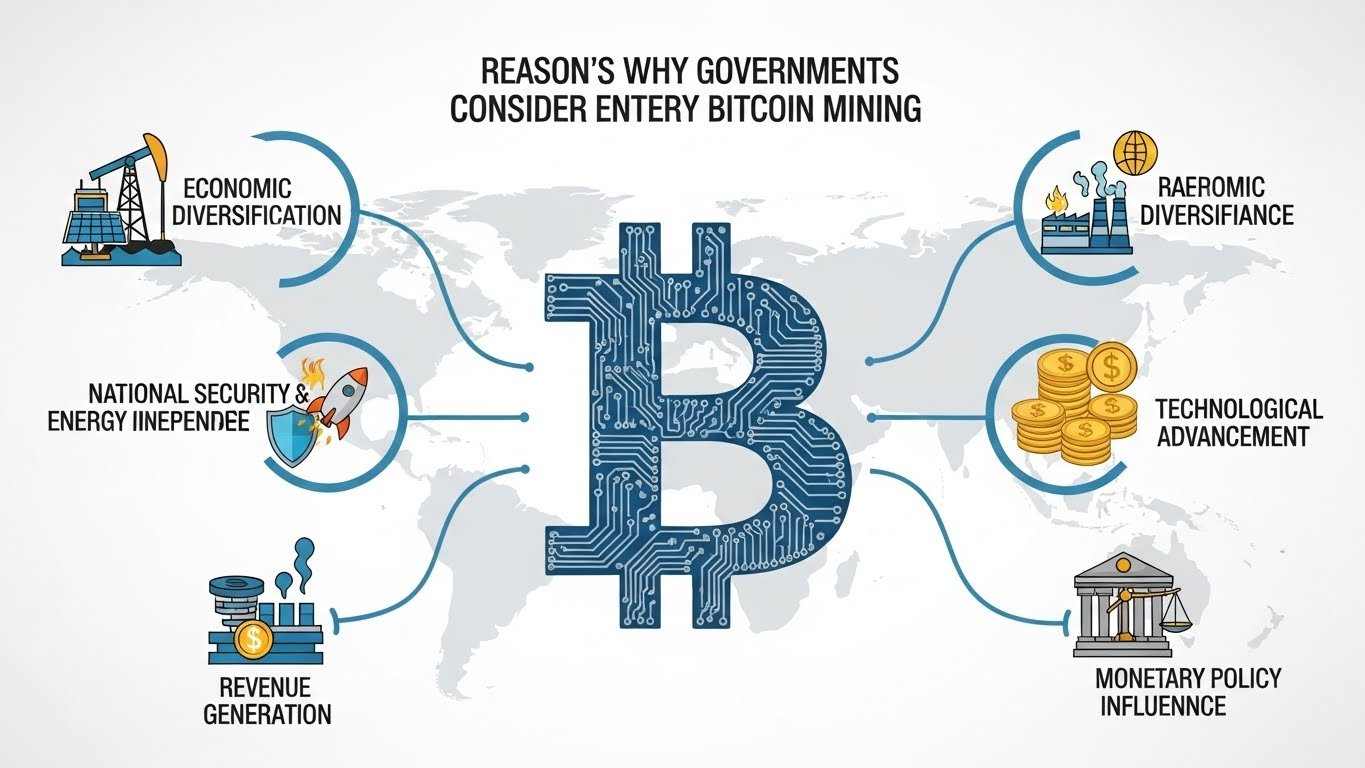

Why Governments Enter Bitcoin Mining

Bitcoin mining requires energy, hardware, and technical expertise. Governments that have access to cheap electricity—especially those with hydro, geothermal, or subsidized power—may see mining as a way to monetize surplus energy and generate revenue in a globally liquid asset.

Mining can also be appealing in regions under economic pressure. Bitcoin provides a method of earning outside traditional banking routes, which can be important for countries facing sanctions or restricted financial access. This is where state-linked mining becomes more than a business; it becomes a geopolitical tool.

National Infrastructure and the Mining Advantage

Unlike private miners, governments can leverage national infrastructure. They may have direct influence over electricity pricing, land access, and industrial policy. That gives them an edge in building mining operations that steadily grow Bitcoin holdings without relying on market purchases.

However, mining also brings risks. It can trigger international scrutiny, spark domestic criticism if power shortages occur, and create corruption opportunities if mining profits are not transparently managed. Still, where conditions align, mining has become a state-aligned strategy for building massive Bitcoin holdings.

Mining, Politics, and Public Perception

Public perception matters. If citizens believe mining profits benefit only elites while everyday people face rising costs, backlash grows. In contrast, if mining revenue funds public services, infrastructure, or economic stabilization, it becomes easier to justify.

This tension shapes how governments discuss mining. Some frame it as innovation, others keep it quiet. Either way, state mining contributes to long-term Bitcoin holdings and changes the power dynamics of the network by expanding who participates in block production.

Custody, Security, and the Reality of Government Wallets

One of the most misunderstood aspects of government Bitcoin holdings is custody. Holding Bitcoin is not like holding gold in a vault. It requires careful key management, multi-signature systems, and strict security protocols.

How Governments Store Bitcoin Safely

Most governments use specialized custody solutions. These may involve cold storage, multi-party control, restricted access policies, and periodic audits. The goal is to prevent theft, insider abuse, and accidental loss. Since private keys are effectively the “ownership,” custody is a core operational challenge.

The stakes are massive. A single compromised key can result in irreversible loss. Unlike traditional bank accounts, there is no central authority that can reverse a Bitcoin transaction. This reality makes government Bitcoin reserves a test of modern security and institutional competence.

Transparency vs. Secrecy

Citizens often demand transparency about state assets. But with Bitcoin, transparency can become a security risk. Publicly confirming exact wallet addresses might invite hacking attempts, surveillance, or unwanted market speculation. As a result, many governments disclose only partial information, sometimes revealing holdings through court documents or oversight reports rather than real-time wallet monitoring.

This tension creates uncertainty in markets. Traders and analysts watch blockchain data and attempt to identify government wallets, but not all identifications are accurate. That uncertainty itself becomes a market factor, making Bitcoin holdings both powerful and mysterious.

Why Some Governments Hold Bitcoin Instead of Selling It

If Bitcoin is seized, why not sell immediately? The answer depends on legal frameworks, market conditions, and long-term strategy.

Legal and Administrative Delays

In many places, agencies can’t liquidate until courts finalize forfeiture. Even after forfeiture, administrative procedures can slow sales. Tender processes, auction planning, compliance checks, and inter-agency coordination all take time.

During these delays, the government’s Bitcoin holdings remain intact and can grow in value during bull markets—sometimes creating political debates about whether holding longer might be beneficial.

Strategic Optionality

Bitcoin’s volatility can be an advantage. Holding Bitcoin offers optionality: the state can sell later, use it in settlements, or even explore regulated integration into financial systems. While most governments do not treat Bitcoin like an official reserve asset, some see value in maintaining a position, especially if their holdings were acquired without direct purchase costs.

The idea of optionality becomes even stronger when Bitcoin is acquired through seizures. In those cases, officials may view it as a bonus asset that can either be liquidated or retained depending on economic needs.

The Global Impact of Massive Government Bitcoin Holdings

Government ownership changes Bitcoin’s narrative. It challenges the idea that Bitcoin exists outside state influence and introduces new market dynamics.

Market Volatility and Whale Watching

Large holders affect market psychology. When governments move coins, markets react—even if no sale occurs. This “whale watching” culture adds a layer of speculation that amplifies volatility. It also encourages more sophisticated monitoring tools, which further professionalize the market.

Because of this, massive Bitcoin holdings held by governments indirectly shape Bitcoin’s trading environment. Even silent custodians can move markets with a single on-chain transaction.

Regulation and Policy Influence

Holding Bitcoin often forces governments to take Bitcoin more seriously. Agencies need rules for custody, liquidation, taxation, and reporting. Over time, this can lead to stronger regulatory frameworks, clearer asset classification, and more standardized approaches to digital currency regulation.

Some fear that governments will use their holdings to justify tighter control. Others argue that ownership increases legitimacy because states become stakeholders in a stable market. Either way, government Bitcoin holdings push policy evolution forward.

Bitcoin as Geopolitical Leverage

In a world where financial networks can be restricted by sanctions, Bitcoin offers an alternative channel of value. Governments that hold Bitcoin may explore ways to use it as leverage, although doing so openly could trigger backlash. Even the possibility influences global debates on sovereignty and money.

This is where Bitcoin transitions from a speculative asset to an instrument of power, making government Bitcoin reserves a topic that extends far beyond crypto circles.

Conclusion

Governments didn’t build massive Bitcoin holdings by following the playbook of private investors. They built them through enforcement actions, court processes, strategic decision-making, and, increasingly, through Bitcoin mining supported by infrastructure and policy power. These holdings exist at the intersection of law, economics, security, and geopolitics, and their influence is growing.

As Bitcoin matures, the presence of governments as major holders will continue to shape market behavior and public perception. Whether these Bitcoin holdings are sold, held, or expanded through mining, one thing is clear: the story of Bitcoin is no longer just about individuals escaping state systems. It’s also about states adapting to Bitcoin—sometimes reluctantly, sometimes strategically—and becoming key players in the very ecosystem they once questioned.

FAQs

Q: Why do governments have so much Bitcoin?

Governments accumulate Bitcoin holdings mainly through seizures and forfeitures tied to criminal investigations. Large cases can transfer huge amounts of Bitcoin into state custody, sometimes for years before liquidation.

Q: Do governments buying Bitcoin influence the market?

Yes. Even small official purchases can influence sentiment because they act as political and financial signals. The perception that a state supports Bitcoin can boost confidence and shape crypto adoption narratives.

Q: Can governments crash Bitcoin by selling their holdings?

In theory, large sales could create downward pressure, but many governments sell through auctions or structured processes that reduce shock. Market reactions often depend more on expectations than actual sale volume.

Q: How do governments store Bitcoin securely?

They typically use cold storage, multi-signature wallets, and regulated custody solutions. Because Bitcoin transactions are irreversible, custody and key security are critical to protecting government Bitcoin reserves.

Q: Why would a government mine Bitcoin instead of buying it?

Mining can turn cheap or surplus energy into a valuable asset, allowing governments to grow Bitcoin holdings without direct purchases. It can also provide revenue streams outside traditional financial systems, though it carries political and operational risks.

Also More: Expect Bitcoin to Hit a New All-Time High in 2026