Bitcoin has always been a market of extremes—extreme optimism, extreme fear, and extreme price movements. But every major cycle shift begins quietly, often hidden beneath headlines that only seem obvious in hindsight. Recently, Bitcoin holders slipped into losses for the first time in years, a development that has reignited debate about whether the market is undergoing a bull-to-bear transition.

For much of the recent cycle, Bitcoin holders enjoyed sustained profitability, with prices comfortably above key cost-basis levels. That environment supported confidence, encouraged dip-buying, and reinforced the belief that any correction would be short-lived. However, as prices weakened and key support zones failed to hold, on-chain data began to reveal a more concerning trend: a growing share of Bitcoin holders are now underwater.

This shift does not automatically confirm the start of a prolonged bear market. Bitcoin has repeatedly dipped into temporary loss phases before resuming higher trends. Yet history shows that when losses spread across the holder base, market behavior changes. Sentiment becomes fragile, volatility increases, and rallies face stronger selling pressure.

This article explores what it really means when Bitcoin holders move into losses, why analysts associate it with a potential bull-to-bear transition, and how investors can interpret the signals without falling into emotional decision-making.

What it means when Bitcoin holders slip into losses

When analysts say Bitcoin holders are “in losses,” they are not referring to individual trades or short-term price fluctuations. Instead, the term reflects aggregate network profitability measured through on-chain metrics that track the average cost at which coins last moved.

Understanding realized price and cost basis

One of the most important benchmarks in Bitcoin analysis is the realized price, which represents the average price at which all circulating Bitcoin last changed hands. When the market price falls below this level, it suggests that the average holder is sitting on an unrealized loss.

Historically, Bitcoin spending extended periods above realized price during bull markets, while sustained trading below it often aligns with bearish or accumulation phases. The recent move into loss territory marks a notable shift from the prolonged profitability that characterized the previous market environment.

Why losses influence behavior

Losses affect psychology. When Bitcoin holders are in profit, they are more likely to hold through volatility or add to positions during dips. When losses dominate, that confidence weakens. Some investors sell to avoid deeper drawdowns, while others exit simply to relieve stress.

As losses spread, selling pressure can become self-reinforcing, especially during periods of declining liquidity or negative macro sentiment.

The bull-to-bear transition explained

A bull-to-bear transition is not a single event—it is a process. It unfolds as market structure, sentiment, and participation gradually shift.

From momentum to distribution

Bull markets thrive on momentum. New buyers enter, prices rise, and confidence feeds on itself. Over time, however, early participants begin taking profits, demand slows, and price appreciation becomes less consistent.

When Bitcoin holders start slipping into losses, it often signals that demand is no longer strong enough to absorb ongoing supply. This creates a transition phase where prices chop sideways or trend lower, frustrating both buyers and sellers.

Early warning signs before full bear markets

Historically, major bear markets were preceded by a combination of signals rather than one decisive indicator. These include declining profitability, weakening volume, reduced speculative activity, and repeated failures to reclaim key resistance levels.

The current profitability shift fits into that broader pattern, which is why analysts are paying close attention.

Key on-chain indicators signaling stress

On-chain data provides insight into what Bitcoin holders are actually doing, not just how price is moving.

MVRV ratio and market valuation

The MVRV ratio, which compares market value to realized value, is a widely used gauge of whether Bitcoin is overvalued or undervalued relative to its cost basis. When this ratio falls below one, it implies that Bitcoin holders are collectively in a loss position.

Such conditions have historically occurred during late bear markets or deep corrections. However, they have also preceded strong recoveries when selling pressure exhausted itself.

Net realized profit and loss

Another critical indicator is net realized profit and loss, which measures whether coins are being sold at a profit or a loss. A sustained move into realized losses suggests that investors are no longer confident in near-term recovery and are willing to lock in negative returns.

This behavior is often seen during market stress phases and can amplify downward momentum if selling accelerates.

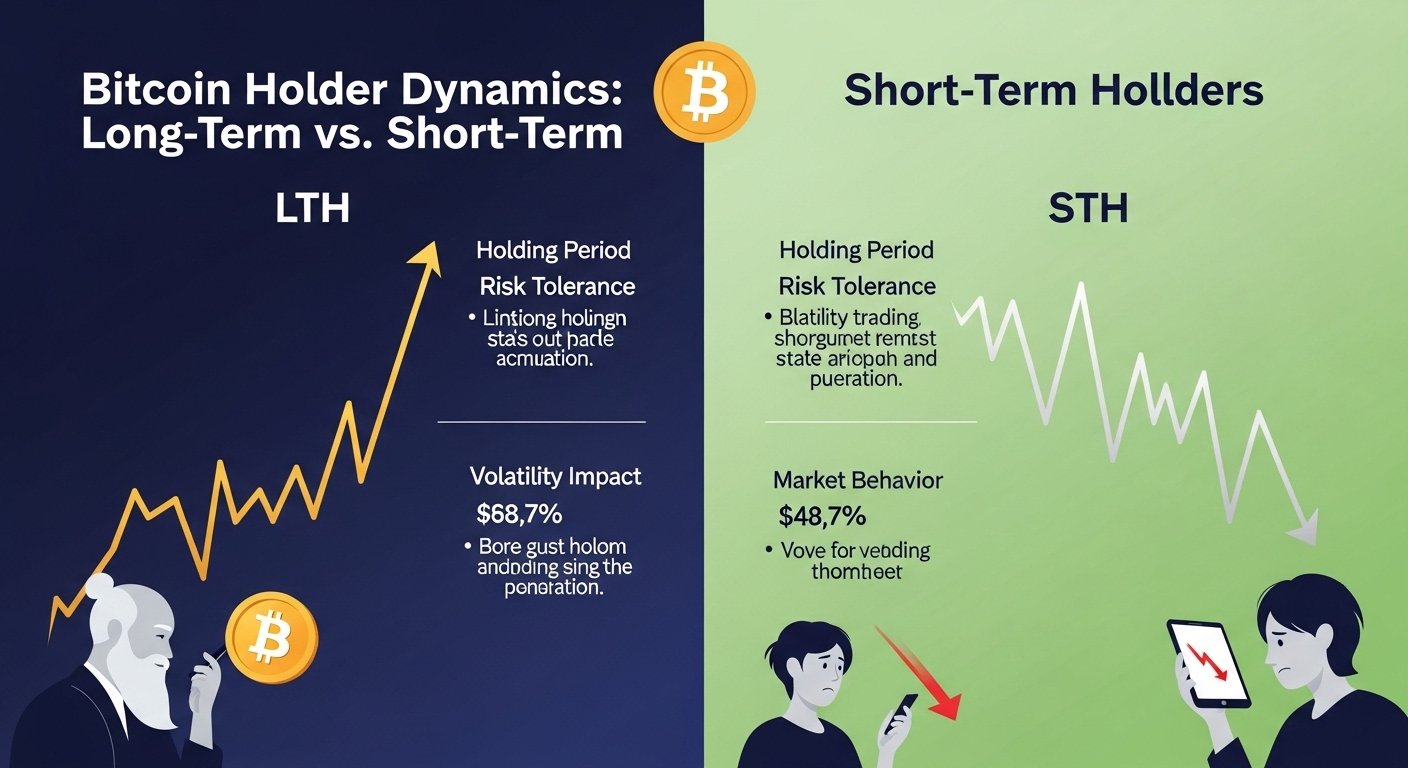

Long-term holders versus short-term holders Bitcoin

Not all Bitcoin holders react the same way to losses. The distinction between long-term and short-term holders is crucial for understanding market dynamics.

Long-term holders and conviction

Long-term holders are typically more resilient. They tend to accumulate during downturns and sell into strength rather than panic during corrections. If long-term holders remain relatively inactive while prices decline, it can indicate that the broader market still believes in higher future valuations.

However, if long-term holders begin distributing their coins, it often marks a more serious shift in market structure.

Short-term holders and capitulation risk

Short-term holders are more sensitive to price changes because their entry points are closer to recent highs. When prices drop below their cost basis, fear-driven selling can increase rapidly.

This type of selling often leads to sharp but temporary declines, sometimes described as capitulation, which can either mark the start of deeper bearish trends or the end of selling pressure.

Market structure changes during loss phases

When Bitcoin holders are in profit, markets behave differently than when losses dominate.

Support becomes resistance

In bullish conditions, key price levels tend to act as strong support. Buyers step in quickly, confident that higher prices will follow. In contrast, during bearish transitions, those same levels often turn into resistance as trapped holders sell into rallies.

This dynamic makes recoveries slower and more volatile.

Increased sensitivity to news and macro events

Loss-heavy environments are more reactive. Negative headlines, regulatory uncertainty, or macroeconomic tightening can trigger outsized moves because confidence is already fragile.

Bitcoin’s correlation with traditional risk assets also tends to rise during these periods, reinforcing downside pressure when global markets weaken.

The role of macroeconomic conditions

Bitcoin does not exist in isolation. Broader financial conditions play a major role in determining whether a loss phase evolves into a full bear market.

Liquidity and risk appetite

Periods of abundant liquidity and low interest rates have historically supported Bitcoin’s growth. When liquidity tightens and investors shift into risk-off sentiment, speculative assets often suffer.

If macro conditions remain restrictive, Bitcoin holders may face continued pressure regardless of on-chain valuation metrics.

Institutional participation and expectations

Institutional involvement has increased Bitcoin’s maturity but also tied it more closely to global financial cycles. While long-term adoption remains a supportive narrative, short-term price action still depends heavily on capital flows and risk tolerance.

Is this a bear market or a mid-cycle reset?

This is the question dominating investor discussions.

Arguments supporting a bearish transition

The case for a bear market rests on declining profitability, increased realized losses, weakening momentum, and repeated failures to reclaim key resistance levels. Together, these signals suggest that the market may be transitioning into a defensive phase.

Arguments for a temporary correction

On the other hand, Bitcoin has repeatedly experienced sharp drawdowns within broader uptrends. If losses remain shallow, selling pressure subsides, and accumulation resumes, the current phase could simply be a reset before another advance.

The difference lies in duration and behavior, not just price levels.

How Bitcoin holders can navigate this phase

Understanding the environment is more important than predicting exact price targets.

Focus on trends, not headlines

Short-term news can be noisy. Bitcoin holders benefit from watching sustained changes in profitability, volume, and holder behavior rather than reacting to daily price moves.

Manage risk without abandoning conviction

Many long-term investors maintain exposure while adjusting position size, reducing leverage, or increasing cash reserves during uncertain periods. This approach allows participation in upside while limiting downside risk.

Use losses as information, not panic signals

Losses provide data about market structure and sentiment. They do not automatically invalidate Bitcoin’s long-term thesis, but they do warrant caution and strategic thinking.

Conclusion

Bitcoin holders slipping into losses for the first time in years marks an important shift in market conditions. While it does not guarantee a prolonged bear market, it serves as a warning that the easy phase of the cycle may be over. Declining profitability, increased realized losses, and changing holder behavior are classic features of a bull-to-bear transition.

For investors, the key is balance—recognizing risk without succumbing to fear, and maintaining long-term perspective while respecting short-term signals. Bitcoin has weathered similar phases before, and how holders respond now will shape the next chapter of the market cycle.

FAQs

Q: What does it mean when Bitcoin holders are in losses?

It means the current market price is below the average cost basis of coins on the network, leaving many holders with unrealized losses.

Q: Does this confirm that Bitcoin is in a bear market?

Not necessarily. Loss phases can occur during both deep corrections and early-stage bear markets. Confirmation depends on how long losses persist and how the market responds.

Q: Why do losses affect market behavior so strongly?

Losses impact psychology. When holders are underwater, confidence drops, selling pressure increases, and volatility tends to rise.

Q: Are long-term Bitcoin holders also selling?

That depends on the cycle. If long-term holders remain mostly inactive, it may signal confidence. Heavy selling from this group often suggests deeper market weakness.

Q: Can Bitcoin recover while holders are still in losses?

Yes. Many historical recoveries began while a majority of holders were still underwater, especially after capitulation reduced selling pressure.